california property tax payment plan

Web Qualifications for a Four-Year Payment Plan. Pay by automatic withdrawal from my bank account.

Property Tax Installment Plans Treasurer And Tax Collector

Web SCC DTAC app provides convenient secure access to property tax information and payments.

. Application for Property Tax Relief for Military Personnel PDF -. It may take up to 60 days to process your request. Web An escaped assessment is a correction to a propertys assessed value that was not added to any prior year Annual Secured Property Tax Bill.

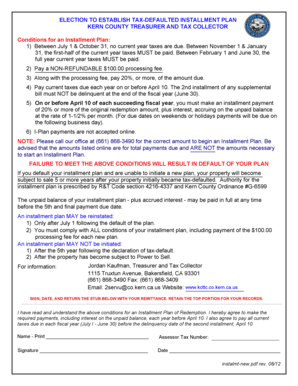

Web The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. Complete the application and. An annual payment plan which if properly maintained will keep the.

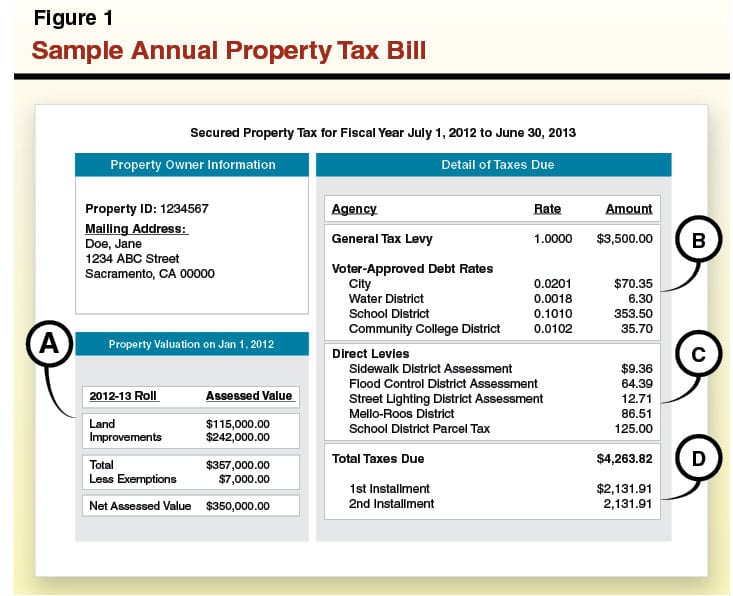

Web According to State law property tax bills must be mailed by November 1 each year and the bills must allow for two installments. A 10 penalty plus 4000 cost is. Web Pay Your Property Taxes Online.

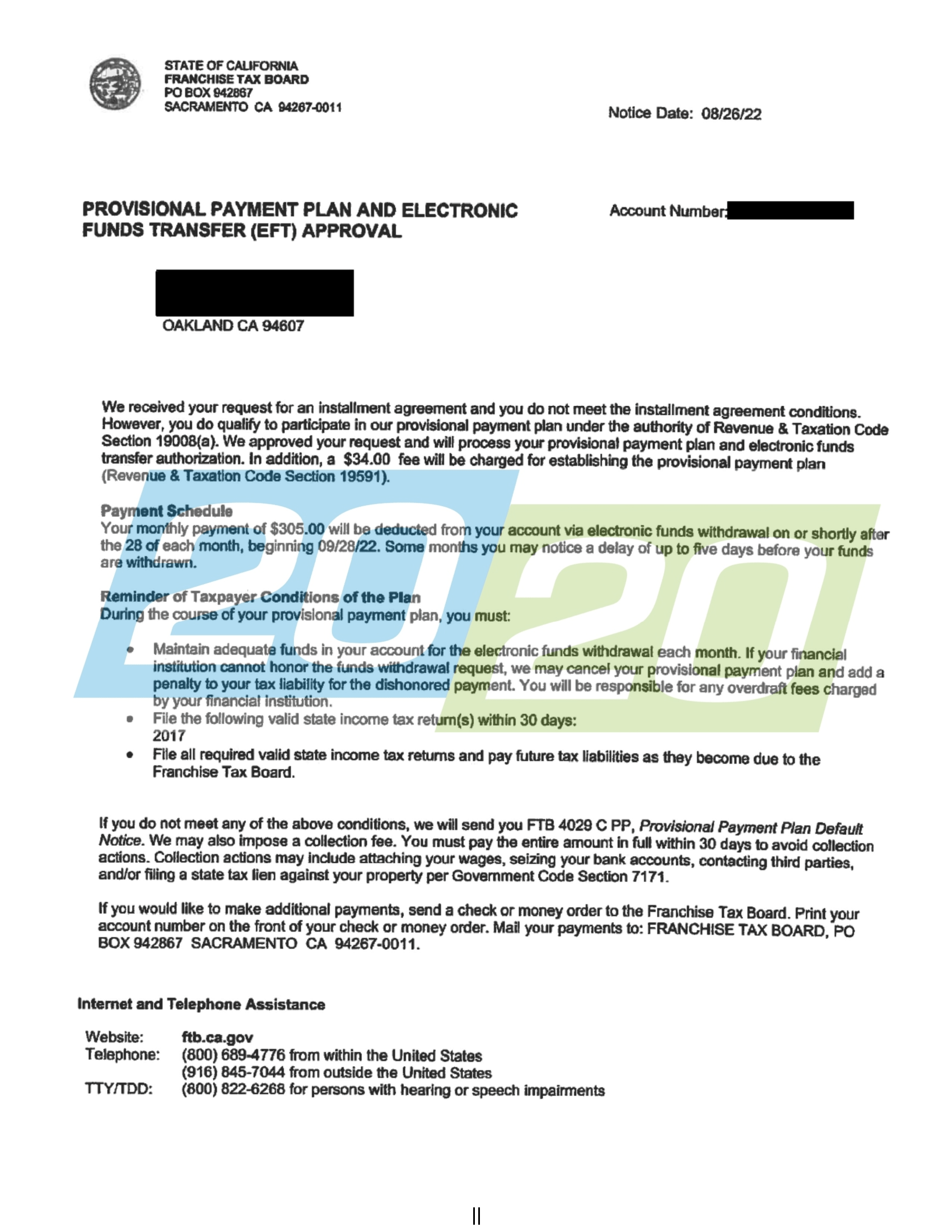

Business and personal property taxpayers in Santa Clara County now have. Web Pay a 34 setup fee that will be added to my balance due. Tax bills for prior year escaped assessments may be paid in installments over a four-year period at your option if all of the following.

Web If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. You will need to use the AIN and Personal Identification Number PIN which is printed on your original. Web Property owners affected by the COVID-19 public health crisis must complete and submit a penalty cancellation request online and include a brief.

These bills are usually the. Web To enroll a bill on the Four Year Payment Plan you must. The first installment is due November 1 and.

Web Second installment of secured taxes due and payable. Second installment of secured taxes payment deadline. Web The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California.

Web The following documents are provided in Portable Document Format PDF and require the free Adobe Reader. Room 101 E Visalia CA 93291. A convenience fee of 25 will be charged for a.

Make monthly payments until my tax bill is paid in full. Web The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California. Web This tax break is available to both single people and married couples filing jointly with an increase of 14000 for a single person and 28000 for a married couple.

Property tax payments must be received or United States Postal. Web There is no cost to you for electronic check eCheck payments. This office is also responsible for the sale of.

Web Property owners affected by the COVID-19 public health crisis must complete and submit a penalty cancellation request online and include a brief statement of how the public health. Web For tax year 2022-23 the first installment is delinquent if not received by Monday December 12 2022 at 500 PM. Web A monthly payment plan designed to pay off the prior year balance before the fifth year of default.

You can pay online by credit card or by electronic check from your checking or savings account. 559-636-5250 221 South Mooney Blvd. File a written request with the Tax Collectors office prior to the due date of the bill.

State Accepts Payment Plan In San Jose Ca 20 20 Tax Resolution

.png?width=1024)

County Of Del Norte California Property Tax Assistance

Irs Payment Plan Installment Agreement Options Nerdwallet

Californians Adapting To New Property Tax Rules City National Bank

State Accepts Payment Plan In Santa Maria Ca 20 20 Tax Resolution

Scv News Property Tax Reform Plan Qualifies For 2020 California Ballot Scvnews Com

California Prop 19 Property Tax Changes Inheritance

Pay Your Property Taxes Treasurer And Tax Collector

State Payment Plan Archives 20 20 Tax Resolution

Pay Your Property Taxes Treasurer And Tax Collector

Kern County Property Tax Fill Online Printable Fillable Blank Pdffiller

Property Tax Calculator Estimator For Real Estate And Homes

Pay Your Property Taxes Treasurer And Tax Collector

Supplemental Secured Property Tax Bill Placer County Ca

Pay Your Property Taxes Treasurer And Tax Collector

Secured Property Taxes Treasurer Tax Collector

California Property Taxes Viva Escrow 626 584 9999